Greenlight Introduces Family Shield Plan to Protect Seniors Against Fraud and Theft

From kids to grandparents, Greenlight now protects safety and finances across all generations

ATLANTA --(BUSINESS WIRE)

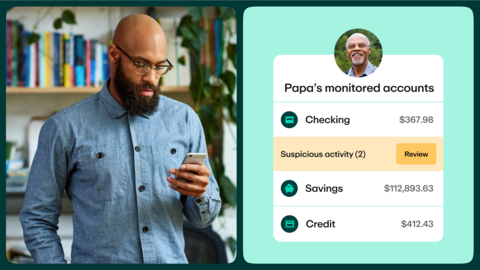

Greenlight®, the award-winning money and safety app for families, today announced the launch of Family Shield, its newest subscription plan designed to help caregivers protect seniors from financial fraud and ensure their physical safety. This first-of-its-kind product streamlines financial account monitoring and alerts, provides protections against fraud (including deceptive transfer fraud2), identity theft2, and money management errors, and offers remote features to help ensure senior safety.1

This press release features multimedia. View the full release here: https://www.businesswire.com/news/home/20250513314357/en/

Courtesy of Greenlight

There has been a massive rise in financial and digital threats, including scams, identity theft, fraud, and age-related money management mistakes, with financial exploitation costing adults 60 and over an estimated $62 billion in 2023. Additionally, personal safety issues are on the rise with more than 200,000 adults 65 and older injured in car crashes each year, and adults simultaneously caring for their children and aging parents, are increasingly overburdened by managing these risks. Greenlight’s Family Shield plan is helping solve the problem by protecting vulnerable, aging parents or dependent adult loved ones’ finances and health through new financial protections and real-time location alerts.

Key features include:

- Financial account monitoring and fraud and scam alerts: Caregivers can link their senior loved ones’ accounts — including checking, savings, investing, and credit cards —and get alerts for suspicious activity like suspected fraud, scams, or financial mistakes. They can also view balance and transaction details in one dashboard and add another adult for extra oversight.

- Deceptive transfer fraud and identity theft insurance coverage2: If a family member is convinced to send money to an imposter acting as a trusted person or business, deceptive transfer fraud insurance may help reimburse them up to $100K. If a family member’s identity is used to take out loans, apply for credit cards, or apply for financial services under their name, recover expenses up to $1M.

- Credit, identity, and dark web monitoring: Family Shield also provides timely alerts for suspicious activity related to identity or personal data usage so families can act quickly if their accounts are compromised.

- Personal safety and connection: Caregivers can see their senior loved ones’ locations and get alerts when they arrive and leave places — including hospitals, community centers, banks, or their homes. With SOS alerts and crash detection with 911 dispatch, older adults can get help in an emergency, and when they are on the road, caregivers can track their trip status and safety through real-time alerts and driving reports.

- Greenlight debit card: Caregivers can choose to get a debit card for their senior loved ones with spend controls and money transfers, real-time transaction alerts, and purchase protection3 — ensuring their older loved ones are spending safely and wisely.

- Educational resources for caregiving: Caregivers often feel overwhelmed and unsure where to begin with legal, financial, and daily tasks. Family Shield offers comprehensive guides, FAQs, tips, and checklists to help caregivers proactively teach senior loved ones how to prevent scams and money mishaps.

“Greenlight’s Family Shield plan was inspired by families who were already adapting our tools to care for seniors,” said Tim Sheehan, co-founder and CEO of Greenlight. “By listening to their needs and learning about their challenges, we identified an opportunity to elevate our mission, empowering families to navigate money and life together across all generations.”

Greenlight’s award-winning debit card and money apphas helped more than 6.5 million parents and kids manage family finances safely while learning critical financial skills like how to earn, save, spend wisely, and invest. With Family Shield, you can now protect your senior loved ones and make the financial caregiving experience more manageable and rewarding.

Starting today, Greenlight Family Shield is available via the app or online here: greenlight.com/family-shield. In addition, the 100+ financial institutions that already partner with Greenlight will now have the chance to offer their clients enhanced protection for their senior loved ones.

About Greenlight

Greenlight Financial Technology is the fintech company on a mission to help families navigate money and life together. Its award-winning app offers a debit card, money management platform, and safety features for the whole family. Kids and teens learn to earn, save, and invest, aging loved ones are protected against financial and digital threats, and caregivers and parents can check in by app and set flexible controls. The app also helps families, from kids to grandparents, stay safe and connected with real-time alerts, location sharing, emergency services, and driving reports.

Greenlight partners with more than 100 leading banks, credit unions, and employers to bring its family finance solution to more families through the Greenlight for Banks, Greenlight for Credit Unions, and Greenlight for Work programs.

- Requires mobile data or a WiFi connection, and access to sensory and motion data from cell phone to utilize safety features including family location sharing and driving alerts and reports. Messaging and data rates and other terms may apply.

- Insurance offered by Acrisure, LLC is provided by ACE American Insurance Company and its U.S.-based Chubb underwriting company affiliates. www.chubb.com. Additional details can be viewed here. See link for policy information.

- Provided by Virginia Surety Company, Inc., cell phone protection is not available to residents of New York.

- The Greenlight Debit Card is issued by Community Federal Savings Bank, member FDIC, pursuant to license by Mastercard International. Greenlight Investment Advisors, LLC, an SEC Registered Investment Advisor, provides investment advisory services to its clients. Investing involves risk and may include the loss of principal. Greenlight is a financial technology company, not a bank. The Greenlight app facilitates banking services through Greenlight's bank partners. For more information, please visit: greenlight.com.

View source version on businesswire.com: https://www.businesswire.com/news/home/20250513314357/en/

Copyright Business Wire 2025

Information contained on this page is provided by an independent third-party content provider. XPRMedia and this Site make no warranties or representations in connection therewith. If you are affiliated with this page and would like it removed please contact [email protected]